On the Hunt

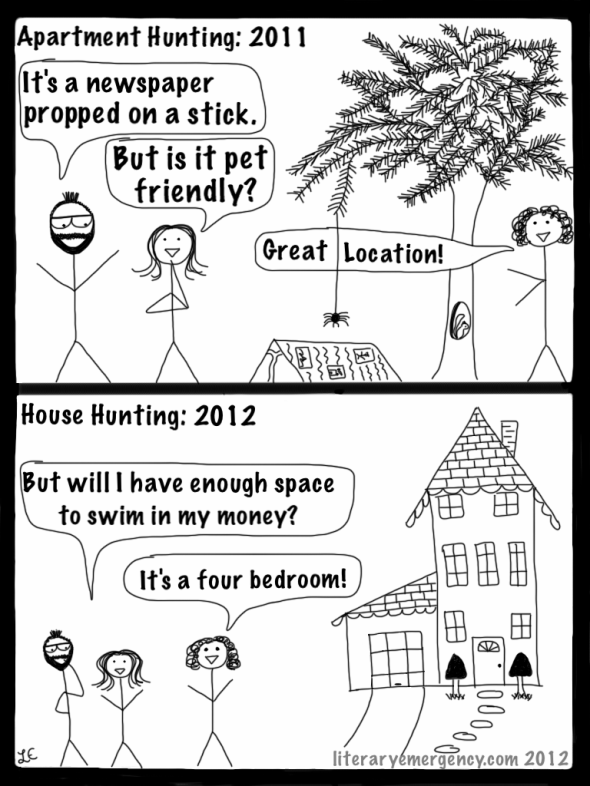

Posted: July 4, 2012 Filed under: Comics, Debt, Grown Up Stuff, Leaving Academia | Tags: Alt-Ac, Comics, Contingent Labor, Employment, House Hunting, Leaving Academia, Mortgage, Student Loans, Unemployment 8 CommentsIt’s been ages since my last post. My bad, guys. Since accepting my full-time alt-ac job, I’ve been busy moving back to the U.S. and attempting to not be homeless. New job is located in my old town, so I am intimately familiar with the dismal rental market ’round these parts. Essentially the options are: 1) over-priced apartments for college students with wealthy families (think NYC rents for NYC-size apartments in a middle-of-nowhere college town); 2) cheap, fire-trap apartments for college students who do not have wealthy families; 3) over-priced, slumlord-managed dwellings in various states of disrepair for non-college students. I’m exaggerating a bit, but the rental market ain’t good. Complicating matters, we’re coming in off-season to a town that runs on the academic calendar (people rent in Feb-April for leases starting the following summer/fall) *and* we have a pet. This left us with slim pickings. A side rant: it makes me very sad to move from a culture where pets–dogs especially–are such an accepted fact of life that one wouldn’t think to question whether or not one’s dog would be “allowed” to be somewhere to a community that seems dog-friendly on the surface (there’s a dog park, etc.), but makes it extremely difficult to actually find housing while owning one.

This is all to say that we decided to buy a house. I know! Turning on a dime here, folks. I had been frantically stuffing money under the mattress when I thought that I might be unemployed, well, forever. Now that I have secured gainful employment, investing in a house seemed like a good option for those funds. So we took a week, looked at some houses, and picked one. Then things got complicated. Having never bought a house before, I thought that job + down payment = mortgage. As it turns out, this is not necessarily the case.

We went through our local credit union for the mortgage. They’ve been great and very helpful so far. They like us. They want to give us money and have us pay interest on it (but not very much!) You know who doesn’t like us? The PMI (private mortgage insurance) company. PMI is what you have to pay every month when your down payment is (in most cases) less than 20%. Another credit union was willing to waive the PMI in exchange for a higher interest rate, but we weren’t fond of their terms. The PMI conditions can be stricter than the bank/credit union’s own underwriters. I mention all this because there are a few details I’ve learned going through this process that might be of interest to other un/under-employed academics. YMMV based on your location, personal circumstances, etc.

1) Employment gaps within the past two years look bad. Even if you were unemployed through no fault of your own. New, awesome job does not automatically cancel out 9 months of unemployment within the past 2 years. This makes you a “higher risk” loan. Not an impossible loan, but one that now requires extra reams of paperwork.

2) It can be difficult or impossible to obtain a mortgage if you are primarily a contingent employee (an adjunct, a lecturer on a one-year contract, etc.). A bank might be willing to work with you if you have evidence that your contract is renewable, spans multiple years, etc., but not always. In our case, the credit union wouldn’t include income from my partner’s contract work in their consideration of our application. This is a real problem for people considering adjunct work through choice or necessity. Not everyone wants to buy a home, obviously, but it’s just one more downside associated with the income instability experienced by contingent faculty.

3) Buying a home requires an obscene (to me) amount of cash upfront. This may seem obvious, but it turned out to be a mild surprise. I’ve watched a lot of HouseHunters in my day (and Property Virgins) and the realtors on those shows are always “roll it into the mortgage” this and “ask the seller to pay closing costs” that. No. Just no. Our sellers aren’t conceding anything (except the price). So all those closing costs are ours to pay. Is it any wonder people stay trapped in over-priced rental apartments?

4) Co-signers are a thing of the past. We didn’t need or want one, but our credit union made sure to disclose that post-housing crisis, the only people who could take out a mortgage were people who were actually living in the house.

5) Student loan debt may or may not be a deal breaker. It is no secret that I have an obnoxious amount of student loan debt. I was worried that the bank would take one look at it and be like, no way, you fiscally irresponsible person who financed 25 years worth of education (that’s the actual number–our mortgage agent counted) [Ed. My SO, a stickler for details, points out that while I have 25 years of education total, I did not finance all of those years]. This did not happen. I had consolidated everything during the federal Special Direct Consolidation Loan period, so my payment should be capped at a reasonable level. This apparently has not worked against me so far, but it’s easy to see how it could. If my student loans were primarily private with high interest rates and monthly payments, then things might be different. Similarly, if both of us had a lot of student loan debt we’d be in mortgage-obtaining trouble.

Right now we are waiting on paperwork and such and keeping our fingers crossed that all will proceed smoothly. I officially start my new gig soon and will post an update on becoming a 9-to-5er when that happens. In the meantime, stay tuned for such thrilling topics as “Retirement Fund Planning for Ex-Academics Who Lack Basic Math Skills” and “Transitioning From Working at Home: Upgrading Your Work Wardrobe From Underwear and a Tank Top to Clothing You Can Be Seen in Public Wearing and Not Be Mistaken For a Homeless Person.” (You know, I started writing that sentence in jest but decided those actually sounded like good post ideas by the end of it).

Great post ideas!! I would find them very helpful…

I’m on it!

Yes, great potential blog posts! Go for it.

I’ve been writing the clothing one in my head for awhile. It’s coming soon!

When we bought our house last year, our bank set us up with two mortgages (both 10 year ARMs): this allowed us to evade PMI because neither mortgage is big enough to require it. I would go to a different back. We went to our credit union and got a run around; we went to our regular bank and bought a great, affordable home with no PMI bla bla bla and no noise about student loans (they did the math so it was clear we could afford payments).

Is it possible you’re moving to a city in Iowa? You’ve perfectly described the crazy rent calendar and pet hostility of my nearby college town. I think buying is totally wise. Wish we’d done it years ago, although we couldn’t have afforded our current, awesome house.

And I will likely be posting about upgrading a dingy grad student wardrobe to something alt-ac-business-friendly-not-embarrassing very soon.

Ooooh, smart! I like it. We wound up working around the PMI, but it was an annoying process all around.

I’m not in Iowa, but I am both sad and unsurprised that this situation exists other places. I wish our national pet culture was more welcoming. I have friend from Toronto who tells me that all apartments there are pet-friendly–there’s no such thing as a rental that doesn’t allow pets. She was very confused by the U.S. dog hate.

congrats on the house owning! and I love the potential blog post ideas too.

its crazy what banks want from people. Taking time off to do a phd = you are untrustworthy. That was my experience when I went to inquire about mortgages. The bank manager said something like, ‘yeah education is really important and we value that. but you have no DATA. we need data.” Data being that steady work history you’re talking about.

Then I made some joke about how it probably would have been a better career move to come a crack dealer. Bank dude did not laugh.

Ha! Some people have no sense of humor.